Finance Weekly Updates

Ex-CEO’s Helping Other Companies

A recent article in the Wall Street Journal from November 10, 2009 points to a new, and quite interesting business trend. A number of businesses are seeing a new trend with former chief executives taking an active role in helping troubled companies. John “Jack” Krol, for instance, was named, in November as outside chairman of Delphi Automotive LLP. Retired from DuPont Co. as their CEO, he is now working on Delphi’s operating plans and strategies.

Dennis Carey, a senior client partner at Korn/Ferry International, explains this trend. As he says, “These chairmen are strategic equal partners of the CEO because they already demonstrated a successful ‘in the trenches’ style of management.”

This trend is certainly most pronounced at struggling companies, but it’s being seen at more big businesses as well. The Corporate Library, a governance research firm, says that 46 former CEOs are now chairmen of other companies. This statistic is up from 14 in 2004.

Edward Whitacre Jr., for instance, a former CEO of AT&T Corp., has recently made television commercials for GM and has played a key role in convincing fellow directors to keep GM’s Opel brand and European operations.

This should prove to be a very interesting trend to continue to follow in the business world.

Introducing the iPad

Apple today introduced iPad, a revolutionary device for browsing the web, reading and sending email, enjoying photos, watching videos, playing games, reading e-books, and much more. Its high-resolution Multi-Touch display lets you interact with content — including 12 innovative new apps designed especially for iPad and almost all of the 140,000 apps. apple.com/ipad

Tips for Buying a Foreclosed Home

One great way to get a bargain today is to buy a home that is under foreclosure. You should be careful, however, if you plan to buy a foreclosed home buy using these five tips. Many companies, such as Keller Williams Realty, Inc., Trammell Crow, Lincoln Property and Kirk Sanford and Sightline Acquisition Corp, can offer even more tips of this sort for benefiting from a depressed economy.

Just because something is foreclosing doesn’t mean it’s a great deal. Sometimes, even the banks overprice their properties. Hire a good realtor and know the market. Pay attention to location; don’t buy in the wrong area just because something is a good deal. Get an inspection and do a title search. Spending a bit of money now can save you a great deal later. Finally, make sure you hire a good attorney.

Just because a foreclosed property might be the best way to go, don’t close out all other options. You might find a better deal with a seller than you do with a bank. Keep all of your options open and be a smart buyer. Surround yourself with knowledgeable people including real estate agents, lawyers and more. Make sure to do all of your homework and to educate yourself about buying a foreclosed home before you sign on the dotted line.

Malaysian Businessmen Optimistic About 2010

According to the International Business Confidence Survey, Malaysia is seen as one of the top ten countries regarded as best able to deal with the global economic crisis. Surveying 7500 businessmen in 24 countries, this survey conducted by Servcorp intended to gauge international business moral. Certainly, Malaysian businessmen such as Taek Jho Low, Regional Development Authority (Irda) chief executive officer Harun Johar, MIDA chairman Dr Sulaiman Mahbob and others should take heart.

Australia received the #1 spot with the highest vote of confidence for their ability to weather the recent global economic crisis, while China and India earned the second and third spots respectively.

The Malaysian economy did register a 6.2 percent negative growth during the first quarter of 2009; however, they have a positive growth forecast in the fourth quarter of 2009 and for the coming year in 2010.

The results of another survey, carried out by accountancy body, CPA Australia, indicate that business leaders in Southeast Asia are optimistic about the end of the global economic downturn. Of the 300 business leaders in the region, including a number in Malaysia, who were questioned, most said that they expect the global economic issues to be over by the end of 2010.

Hedge Funds Help Families Acquire Homes

The hedge fund community of New York has established an organization in conjunction with Habitat for Humanity whose mission is to help hard-working New York families fulfill their “once-in-a-lifetime” dream of home ownership.

These are families that without the intervention of Habitat and the support of hedge funds and private equity firms would not be able to compete for purchase of real estate in New York City.

Hedge Funds for Habitat-NYC is supported by some of the leading hedge fund and private equity firms in New York, including but not limited to:

Jason A. Press

The N.I.R. Group LLC, Corey Ribotsky, Managing Partner

Walter Noel

PNC MultiFamily Capital

Tullett Prebon Holdings Corp

Vantage Partners

Looking for a Tax Haven: Try Delaware, USA

Coming out ahead of both Switzerland and Luxembourg, the American state of Delaware was ranked first as the most opaque tax haven by the Tax Justice Network. The TJN is an organization whose mandate is to promote transparency in international finance.

Coming out ahead of both Switzerland and Luxembourg, the American state of Delaware was ranked first as the most opaque tax haven by the Tax Justice Network. The TJN is an organization whose mandate is to promote transparency in international finance.

Although Switzerland received the highest score for secrecy, here called opacity, along with several other countries such as Malaysia and small Caribbean countries like Barbados, when calculated together with the country’s importance as a place of cross-border financial activity, Delaware outranked these other countries.

The outcome of the ranking is as follows:

USA (Delaware)

Luxembourg

Switzerland

Cayman Islands

United Kingdom (London)

Ireland

Bermuda

Singapore

Belgium

Hong Kong

Finance Weekly Profile: Alan Quasha

From time to time we like to profile interesting and/or successful individuals making news in the world of finance. Alan Quasha is perhaps best known for his great talent restructuring companies. Among his more recent endeavors have been the restructuring of Genius Products. Formerly owned by Harvey and Bob Weinstein, Genius is an entertainment distribution company. Alan Quasha also facilitated the acquisition of the private equity operation of Lehman Brothers by the investment firm Reinet Investments.

From time to time we like to profile interesting and/or successful individuals making news in the world of finance. Alan Quasha is perhaps best known for his great talent restructuring companies. Among his more recent endeavors have been the restructuring of Genius Products. Formerly owned by Harvey and Bob Weinstein, Genius is an entertainment distribution company. Alan Quasha also facilitated the acquisition of the private equity operation of Lehman Brothers by the investment firm Reinet Investments.

Alan Quasha is a principal at Quadrant Management, an investment firm which focuses its resources on U.S. and emerging markets.

Alan Quasha started restructuring companies over thirty years ago when there was not much financial incentive to perform this task as an agent. Therefore, he learned early through necessity that the best approach was to become a partner in the process. This philosophy has assured many years of successful restructuring ventures and earned Alan Quasha his well-deserved excellent reputation.

Being a shy man by nature, Quasha has always avoided the limelight. He is associated with several other investment firms in addition to Quadrant, including Carret Asset Management Group and Vanterra Capital, where he is the founding principal of this global private equity fund.

Spirits Rise with Hedge Fund Gains

Hedge Fund managers have been in a good mood lately as world markets seem to head upwards, shaking off the unpleasant memories that hopefully is all that is left of 2008,one of the worst years in financial history.

The month of July alone saw the Eurekahedge Hedge Fund Index climb an additional 2.1 percent, adding another month to the five month growth streak of 2009.

To date the Index has improved an impressive 12 percent, with hopes for the rest of the year high.

Another index, the MSCI World Index soared 8.4 percent just in July bringing its year-to-date upward climb to 14%.

This extraordinary improvement relied mostly on the success of the fund managers of the Asian and emerging markets sectors.

“The month’s returns were achieved on the back of strong rallies across underlying equity markets despite a rough start to the month,” Eurekahedge wrote in its report.

This is good news to the hears of fund managers all over the world such as John Paulson, Eric Sprott of Sprott Hedge Fund

PIPE Investment Not a Pipe Dream For GM

As the financial world continues to feel the reverberations of one of the most daring, controversial and largest bailouts of a publicly traded company by the U.S. government in history, that is the General Motors decline into bankruptcy and the U.S. government’s bailout, Corey Ribotsky believes he is seeing just another PIPE investment, albeit on a grander scale.

In an opinion piece which appeared in HedgeWorld News, the managing partner and head portfolio manager of the NIR Group of Roslyn, New York, Corey Ribotsky, described the many ways in which the recent U.S. government bailout of General Motors Corporation resembles a PIPE deal which Ribotsky’s investment firm has been dealing with for years.

PIPE is an abbreviation for private investment in public equity, and according to Ribotsky’s take on the bailout, the U.S. government is investing in the publicly held equity of General Motors, or what’s left of it.

Investigators Warn: Stess Tests Not Enough

The Oversight Panel which is supervising the U.S. government bailout of banks to the tune of $700 billion issued a report Tuesday, June 9th, stating that the Federal Reserve used “conservative and reasonable” methods for the assessment of the well-being of the country’s largest banks.

However the panel also said that the Fed’s most pessimistic scenario was not far reaching enough. One example is that the “stress tests” which were conducted by the Federal Reserve bases their conclusions on 2009 unemployment figures which averaged 8.9%. This year unemployment actually reached 9.4% in the month of May.

“While no one should gainsay the potentially positive results of the tests, it would be equally unwise to think that those results reflect a diagnosis of all of the potential weaknesses or create a necessarily sufficient buffer against future reverses for the banking system,” warned the panel in their report.

Do Investors Get Unbiased Research From Wall Street?

Appearing before a United States’ House of Representatives’ subcommittee hearing to discuss “Analyzing the Analysts: Are Investors Getting Unbiased Research from Wall Street?” Gregg Hymowitz, a founder and principal of EnTrust Capital Inc. offered his opinion as testimony. This thought provoking testimony can be viewed in full by following the link.

Shareholders Arise: Take More Responsibilty for Banks’ Policies

Shareholders seem to be taking their rights more seriously as banks observe larger turnouts at their annual shareholder meetings. According to an article in the Wall Street Journal (which can be seen in full here) it has been observed by the proxy voting agency Manifest for Financial News that the average proportion of shares which were represented and the annual meetings of Europe’s twelve largest banks went up to 52% this year from 46% last year. This increase in attendance is seen as a response to the financial crisis which is perceived to be largely the fault of risky practices and other management decisions made by banks without the direct involvement of the majority of shareholders.

According to David Ellis, the corporate governance manager of proxy voting consultancy Pirc,

“The increase in turnout is not surprising given the issues faced by the banking industry over the last year and is an indication that shareholders are taking their rights as owners seriously and willing to keep management in check.”

“The figures are also a reaction to the crisis. The next step is for shareholders to get proactive and engage with companies to make sure it does not happen again.”

Turbulent Times

The past several months have been a roller coaster of ups and downs for the major market indicators. These markets are reflecting great uncertainty and the caution practiced by investors as the U.S. and international economic scene continues to show signs of trauma.

The Unique Advantage of Hedging with the NIR Group

As investors continue to feel the stress of bear markets, sluggish growth and financial uncertainty, many are looking for new ways and innovative strategies to make their dollars work harder for them.

One choice many investors have been exploring recently is investing in hedge funds. These specialized investment vehicles reduce the risk of market fluctuations on stock value while carefully choosing investments in companies with strong growth potential. This creates a fund which is less susceptible to the general market fluctuations and more likely to increase in real stock value.

There are many firms which specialize in hedge fund investment. One of these is the well-known NIR Group, headquartered in Roslyn, New York and headed up by Corey Ribotsky, head portfolio manager. The NIR Group has an additional unique feature, and that is the principals are not just managers of the funds, but are investment partners right along with their clients. This means that clients and managers always share the risks and are never subject to conflict of interest. This is a distinct advantage to investors and makes the NIR Group an excellent choice for investing at a time of economic uncertainty.

Investor and Money Manager Should Ride the Wave Together

In today’s investment world of bear markets and bankruptcy it is no surprise that investors are proceeding with utmost caution and reassessing their entire investment strategy. One area of investing that is perhaps taken for granted but shouldn’t be is the relationship between the money manager and the investor.

In today’s investment world of bear markets and bankruptcy it is no surprise that investors are proceeding with utmost caution and reassessing their entire investment strategy. One area of investing that is perhaps taken for granted but shouldn’t be is the relationship between the money manager and the investor.

Taking a deeper look we can see that there can be an inherent, if unseen, conflict of interest between the investor and the money manager whom he has hired to work for the best interests of the investor. Unless the money manager is equally invested with the people he is working for, there may be times when what is good for the money manager might not be equally good for the investor.

Harry Rady, CEO of Rady Asset Management located in San Diego, California has written an in depth article on this crucial subject. Rady is one of the more sought-after analysts of the economy today, frequently interviewed on CNBC’s “Closing Bell”, Fox Business News and other influential financial news programs. He also writes extensively on financial issues.

We recommend taking his opinion into account when about to embark on any new investment or financial decision.

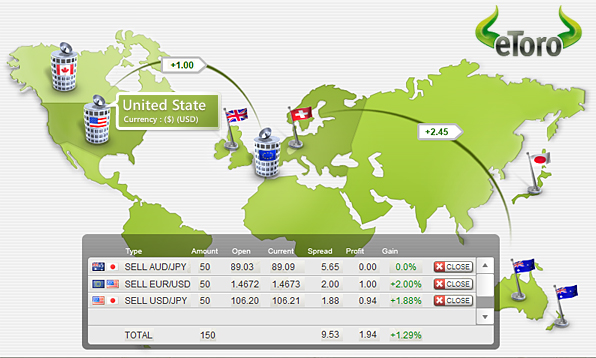

eToro’s Forex Trading Platform Secures $6.3M

Reprinted from http://www.vccafe.com

Israel-based eToro has secured $6.3 million in Series B financing from BRM Group, Cubit Investments and other unnamed investors. eToro offers an online financial trading platform that helps less experienced traders to easily conduct foreign exchange trades via a simple user interface. eToro’s interface provides six different “trading arenas” for traders ranging from beginners to experienced traders.

No matter if the economy is booming or crashing, traders thrive in volatile markets and eToro is enjoying the effects. Since September the company has doubled its staff, adding several thousand new users a month. Most recently, eToro added long term Commodities Trading.

According to CEO and Co-Founder Jonathon Assia:

“Our vision of becoming the online destination and trading platform for everyday people has taken a quantum leap forward with our new platform. With more long term investors turning to forex as financial markets around the world continue to struggle, eToro has developed the platform with tools and parameters for the more conservative forex investor on the go.”

Down we go again: Faint hope vanishes on Wall St.

NEW YORK — So you thought Wall Street might be out of the woods? Think again.

A surge of optimism that started a market rally late last year, mercifully quieting the stock market’s stomach-churning volatility, has vanished as economic recovery recedes further onto the horizon.

On Wednesday, stocks took a dive reminiscent of the terrifying jumps and drops of last fall, with the Dow Jones industrials falling more than 300 points before closing down 248.

It was the Dow’s biggest point drop since Dec. 1 and the first string of six straight down days since early October. The Dow is still 9 percent higher than its November low, but the bumpy decline feels all too familiar.

“It’s a good instinct to start a New Year off with optimism,” said Art Hogan, chief market analyst at Jefferies & Co. in Boston. “But unfortunately that tends to fade in the harsh light of reality.”

So what happened?

Holiday sales turned out to have been worse than expected, the jobless rate exceeds 7 percent for the first time in 16 years, the global economy is eroding faster and corporations from Alcoa to Intel to Wal-Mart have disappointed investors.

Apple was the latest company out with bad news Wednesday, with CEO Steve Jobs saying he is taking a medical leave of absence.

“Right now we just don’t have any evidence to show that that free fall is over,” said Robert Dye, senior economist at PNC Financial Services Group in Pittsburgh.

For a time, it seemed like the worst might be over for stocks. After hitting a trough on Nov. 20, the major stock averages all rose by more than 20 percent within six weeks – the kind of rally that usually takes years.

The rally was driven in part by hopes for Washington’s aggressive fiscal policies and the upcoming change in the White House. But lately bears rule Wall Street again as one corporate report after another spreads gloom.

Like others, Dye thinks the market could fall back toward the low point of November. That was when the Standard & Poor’s 500 index reached its lowest close in 11 years, at 752, and the Dow reached its lowest in more than five years, at 7,552.

On Wednesday, the S&P closed at 843, the Dow at almost exactly 8,200.

Stock market recoveries usually precede economic recoveries by about six months. Translation: Investors don’t expect the economy to turn around before the second half of this year.

“Wall Street wants instant gratification, but economic cycles take years and an economic cycle like this is going to be deeper, longer and uglier than any one we’ve ever faced,” said Harry Rady, chief executive and portfolio manager for Rady Asset Management in San Diego.

Sam Stovall, chief investment strategist at S&P, puts it another way: Investors have put on their 3-D glasses, trying to figure out “the depth, the duration and the diffusion of this global economic slowdown.”

And not having much luck.

For now, Hogan says stocks may trade in a much narrower range than they did during the white-knuckle days of October and November, when the Dow routinely rose or fell by 500 points or more in a day.

That range is perhaps 8,000 to 9,000 for the Dow, and 825 to 910 for the S&P, Hogan says. But more bleak news from corporations or Washington could still steer it lower.

For those looking for hopeful signs, consider these:

– Only once since World War II have stocks bounced back 20 percent in a bear market without signaling the start of a new bull market, according to Stovall. That lends hope the surge could resume in the not-too-distant future.

– A huge amount of money that was pulled out of stocks in last year’s big sell-off remains on the sidelines and should re-energize the market at some point when investors see more encouraging signs, according to Liz Ann Sonders, chief investment strategist for San Francisco-based brokerage Charles Schwab Corp. At year’s end $8.85 trillion sat in cash, money markets and savings accounts, an all-time high, she noted.

Other experts urge calm and suggest putting the recent slide in perspective.

Robert Doll, global chief investment officer for the investment firm BlackRock, says the market’s latest swing down is normal and was to be expected after a 20 percent rise and some bad data.

“We’re going to get more bad data and we should expect some more selling squalls,” he said.

Just keep those rose-colored glasses in your drawer for a while.

Dye said stocks could fall again if Washington isn’t quick to come up with planned spending to boost the economy after President-elect Barack Obama takes office next week.

There is an expectation that we’re going to have an $800 billion package in place very quickly, he said. “If that doesn’t happen in a timely fashion that would be another negative for the markets.”

On Recessions and Depressions

What is the difference between a depression and a recession, and which are we experiencing now? Until the Great Depression, and for some time after, any downturn in economic activity was known as a depression. But in the late 20th century, economists and politicians were reluctant to alarm the public by using that loaded term, and so they coined the alternative, “recession” to denote a relatively minor economic downturn. Some have attempted to give formal definitions, based on the extent of shrinkage or the duration of the negative period. But the best definition remains the somewhat humorous one: “A recession is when other people lose their jobs. A depression is when you lose yours.” To this we may add, for the current recession: “A recession is when other people lose their homes, a recession is when you lose yours.”

The Year of the Flat Screen

Even with an atmosphere of restraint and a renewed commitment to fiscal responsibility, this may be the year when more Americans than ever get flat-screen TVs and computer monitors. It looks at though manufacturers have prepared too many for the holiday season, and will be forced to sell at rock-bottom prices. News of a federal investigation into price-fixing schemes between manufacturers also portends an imminent downturn in prices. We are already witnessing heavily reduced pricing in the context of holiday sales, below the traditional $10/inch barrier, and consumers are unlikely to accept a return to old prices once they have experienced the new lows.

British Real-Estate Crisis Looms

If you’ve been to the UK in the last couple years, you know how expensive land is there. The country is small, populous and developed, all factors that contribute to legitimate rise in land cost. But lately prices seem to have climbed beyond reasonable levels. Analysts have observed that there is not currently enough wealth in all of England to cover the mortgage costs held by the citizenry. This includes bank assets! Were homeowners to experience a “call”, there would be a huge shortfall and many would lose their homes, to banks who would then be unable to sell them for anywhere near their supposed value. The banks, in turn, would default on their obligations to foreign investors.

This alarming situation could lead England the way of Iceland – a sudden and harsh awakening to national insolvency.